The Doji Pattern is a key candlestick formation that signals indecision in the market, often indicating a potential trend reversal. It is widely used by traders to identify crucial turning points and make informed trading decisions.

The Doji Pattern is a powerful candlestick signal that shows market indecision and can indicate a trend reversal. To learn how to use this pattern effectively in your trades, keep reading at Forex Bit!

What is the Doji Pattern?

The Doji pattern is a candlestick formation that indicates indecision in the market. It occurs when a candlestick’s open and close prices are nearly identical, resulting in a small body and long wicks (upper and lower shadows). This unique structure signifies that buyers and sellers are in a state of equilibrium, with neither side able to gain control.

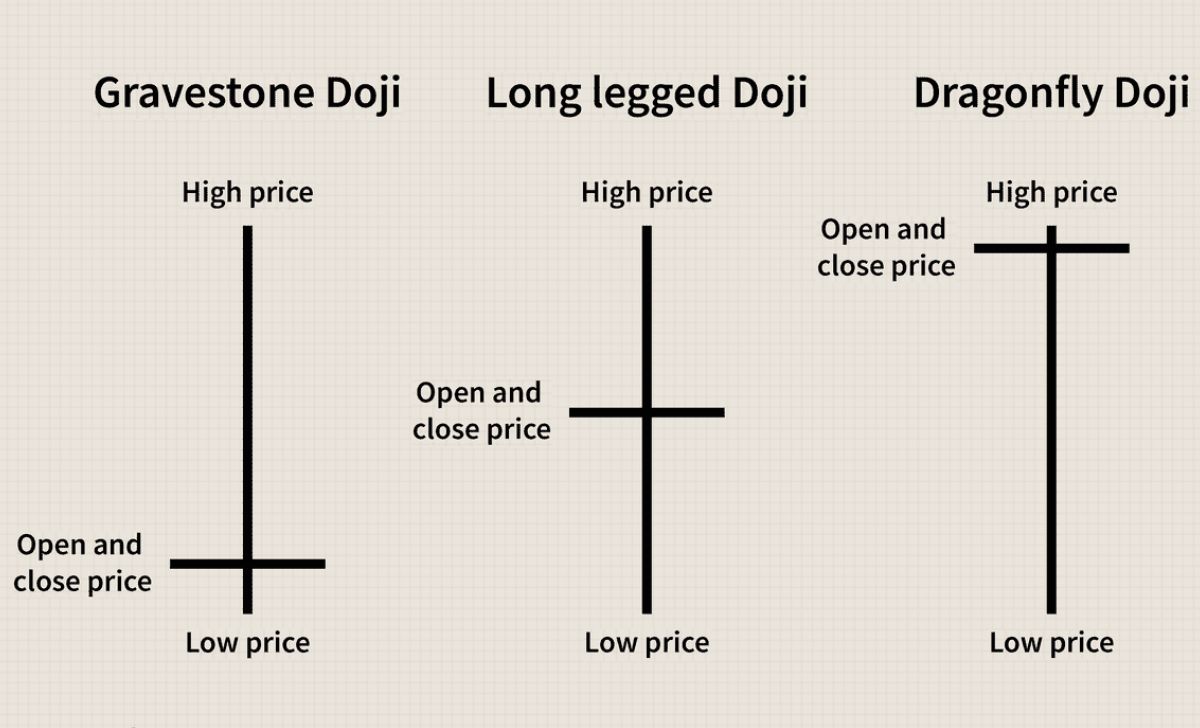

There are several types of Doji candles, such as the long-legged Doji, dragonfly Doji, and gravestone Doji, each representing different market conditions. However, they all share one common characteristic: they signal a potential reversal or continuation in the market trend, depending on the context in which they form.

What Does the Doji Pattern Mean?

The Doji pattern is a powerful signal in technical analysis because it highlights moments of uncertainty or indecision in the market. When a Doji candle pattern appears after a prolonged trend, it can indicate that the trend may be losing momentum and a reversal could be on the horizon. Traders often look for the Doji pattern at key support or resistance levels, as it can signal that the price is about to reverse direction.

However, the Doji pattern alone is not enough to confirm a trend reversal. Traders typically wait for confirmation from subsequent candles or other technical indicators, such as volume or moving averages, before making a trading decision.

Doji Pattern Bullish and Bearish Signals

The Doji pattern can appear in both bullish and bearish market conditions, and the context in which it forms is crucial to understanding its signal.

- Doji Pattern Bullish: A Doji bullish pattern occurs when a Doji candle appears at the end of a downtrend, signaling that the market may reverse and begin an upward movement. The bullish Doji pattern is often confirmed by a strong bullish candle that follows, indicating that buyers are gaining control. This type of pattern suggests that market sentiment is shifting in favor of the bulls, and traders may consider entering a long position.

- Doji Pattern Bearish: Conversely, a Doji bearish pattern forms at the peak of an uptrend, signaling a potential reversal to the downside. When a Doji candle pattern appears after a strong bullish trend, it indicates that the buying momentum is weakening, and a downtrend could be imminent. A bearish confirmation candle, such as a strong bearish candlestick, often follows the Doji pattern, signaling the start of a downtrend. Traders may consider this a signal to sell or short the market.

How to Use the Doji Pattern in Trading

While the Doji pattern is a helpful indicator of indecision in the market, it is essential to use it in conjunction with other technical tools to make well-informed trading decisions. Here’s how to incorporate the Doji pattern into your trading strategy:

- Look for Confirmation: A Doji pattern by itself does not guarantee a trend reversal. Always wait for confirmation from subsequent candles or other technical indicators. For example, after a bullish Doji pattern, look for a strong bullish candle to confirm the upward movement. Similarly, after a bearish Doji pattern, wait for a bearish candle to confirm the downward reversal.

- Identify Key Support and Resistance Levels: The Doji pattern is most reliable when it forms at key support or resistance levels. These areas represent significant points where the market may reverse, making the Doji pattern a more powerful indicator. Always combine the Doji pattern with trendlines or other support/resistance tools to identify potential entry and exit points.

- Use with Other Indicators: For more accurate predictions, combine the Doji pattern with other technical indicators like Relative Strength Index (RSI), Moving Averages, or Bollinger Bands. These indicators can help you confirm whether the market is overbought or oversold, increasing the chances of a successful trade.

- Timeframe Considerations: The Doji pattern can appear on any timeframe, but its reliability increases on higher timeframes like the daily or weekly chart. A Doji pattern on a longer timeframe carries more weight and often provides a clearer picture of market sentiment.

In conclusion, mastering the Doji Pattern can significantly enhance your trading strategy by helping you identify potential trend reversals. With practice and a clear understanding, you can use this pattern to make more informed trading decisions. To deepen your knowledge and learn Forex, join Forex Bit today!

As a Financial Blogger with 5 years of experience, I focus on delivering in-depth market insights, investment strategies, and personal finance advice. My content has helped a diverse audience navigate the complexities of financial planning and stay informed about the latest trends in the financial world.

Email: [email protected]