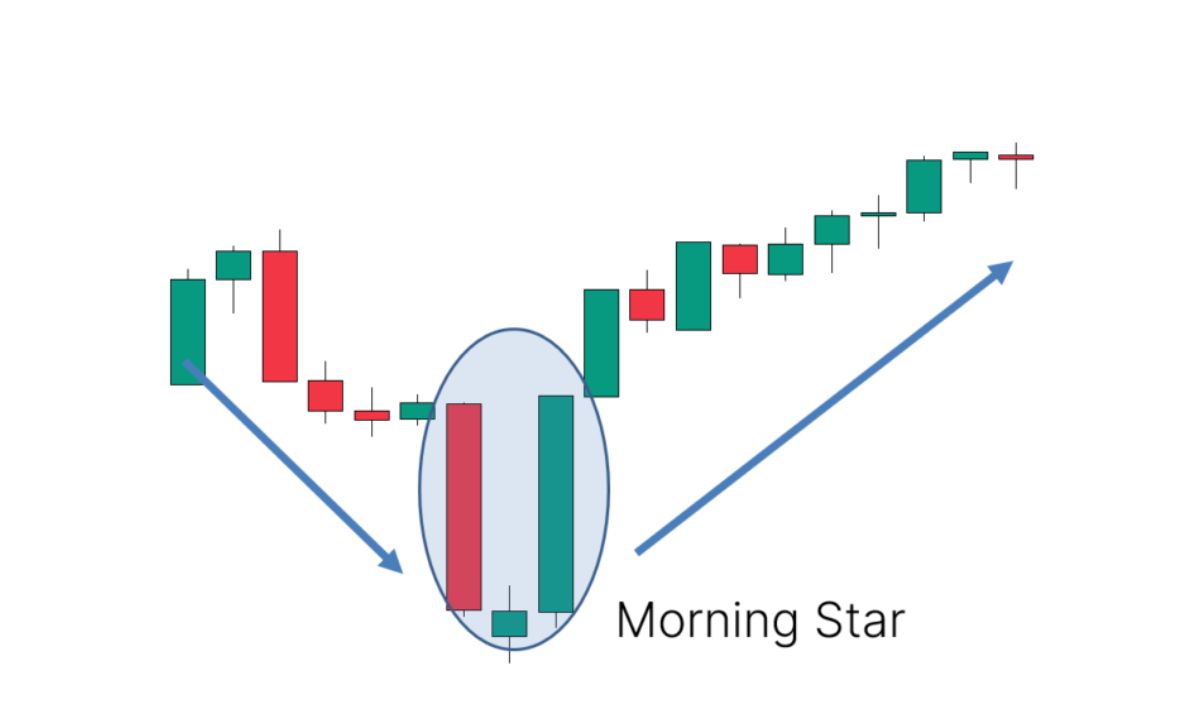

The Morning Star Pattern is a bullish candlestick formation that signals a potential reversal from a downtrend to an uptrend. It typically consists of three candles: a long bearish candle, a small-bodied candle, and a long bullish candle, indicating a shift in market sentiment.

The Morning Star Pattern is a powerful technical indicator that traders often use to identify trend reversals in the market. To fully understand how this pattern can enhance your trading strategy, keep reading this article on Forex Bit.

What Is the Morning Star Pattern?

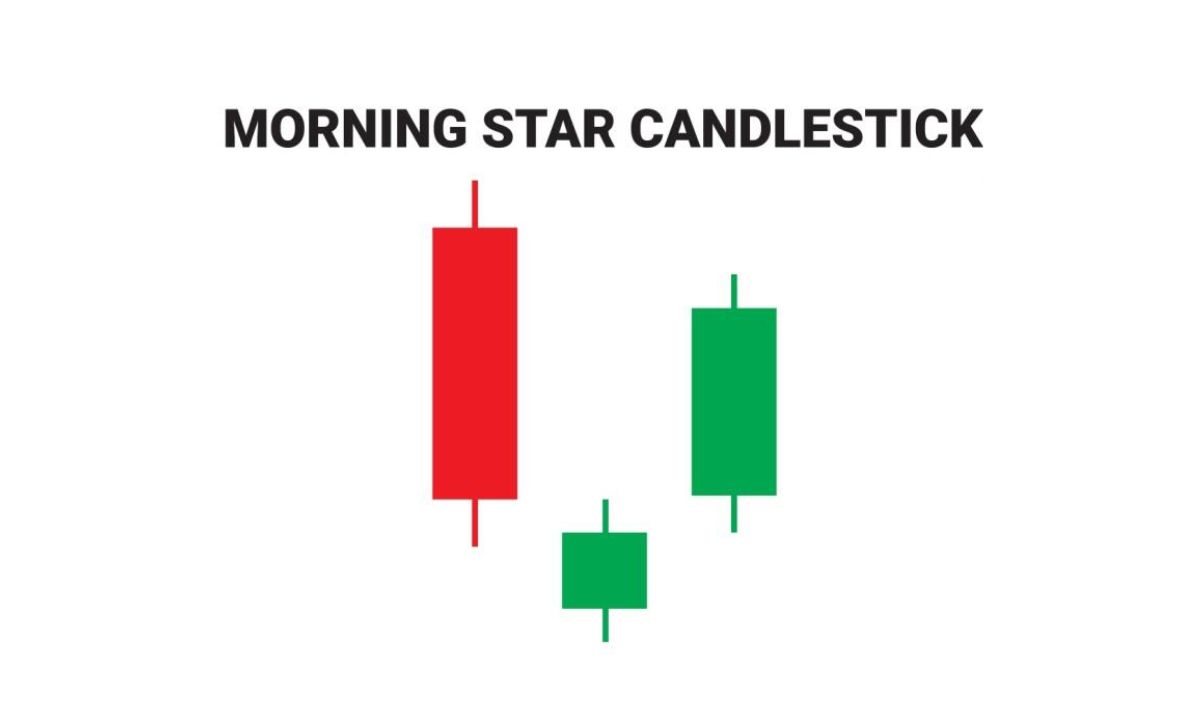

The Morning Star Pattern is a bullish reversal pattern that signals the end of a downtrend and the potential beginning of an uptrend. It consists of three candles:

- The First Candle: A long bearish candle that reflects strong selling pressure.

- The Second Candle: A small-bodied candle (either bullish or bearish) that indicates indecision or a pause in market movement.

- The Third Candle: A long bullish candle that signals buyers regaining control and pushing prices higher.

This pattern is commonly found in stock charts, hence the frequent search term “morning star pattern stocks.” It’s considered a powerful signal when confirmed by other technical indicators like volume or support levels.

Characteristics of the Morning Star Candlestick

Understanding the morning star candlestick is crucial for identifying this pattern correctly. Here are its defining features:

- Gap Formation: Typically, the second candle gaps down from the first, and the third candle gaps up from the second. This is more noticeable in stock markets.

- Reversal Signal: It highlights a shift in market sentiment from bearish to bullish.

- Volume Support: Higher trading volume on the third candle adds confirmation to the pattern.

By studying these characteristics, traders can confidently incorporate the morning star candle pattern into their trading strategies.

How to Identify the Morning Star Pattern

Spotting the Morning Star Pattern requires attention to detail and familiarity with candlestick charts. Here’s a step-by-step guide:

- Look for a clear downtrend in the market.

- Identify the three candles described earlier.

- Confirm the pattern with additional tools like Relative Strength Index (RSI) or Moving Averages.

- Check for a price gap between the first and second candles and between the second and third candles.

For those interested in morning star pattern stocks, combining this pattern with fundamental analysis can further improve accuracy.

How to Use the Morning Star Pattern in Trading

Once identified, the Morning Star Pattern can be used effectively in trading:

- Entry Point: Place a buy order above the high of the third candle.

- Stop-Loss Placement: Set a stop-loss below the low of the second candle to manage risk.

- Target Setting: Use previous resistance levels or Fibonacci retracements to set profit targets.

The morning star candle pattern works best when used alongside other technical tools, such as trendlines, support/resistance levels, and oscillators.

Morning Star Pattern in Stocks

In the stock market, the Morning Star Pattern stocks can indicate a turning point for individual equities or broader indices. It’s particularly effective when identified near major support zones or following significant downtrends.

For example, if a stock shows this pattern after a prolonged sell-off, it’s likely to attract buyers, pushing prices higher. Traders can scan for such patterns using charting software to spot opportunities.

Advantages of the Morning Star Pattern

- Simplicity: Easy to identify on candlestick charts.

- Reliability: Proven effectiveness in various markets.

- Versatility: Applicable across different timeframes and asset classes.

These benefits make the Morning Star Pattern a go-to tool for many traders.

Limitations of the Morning Star Pattern

Despite its advantages, the pattern isn’t foolproof:

- False Signals: Without confirmation, it may lead to incorrect trades.

- Subjectivity: Interpretation can vary among traders.

- Market Conditions: Works better in trending markets than in choppy or sideways markets.

To mitigate these limitations, always use the morning star candlestick in conjunction with other analysis methods.

Key Tips for Trading the Morning Star Pattern

- Use Confirmation: Wait for the third candle to close before entering a trade.

- Analyze Volume: Higher volume on the third candle strengthens the signal.

- Combine Tools: Pair with other technical indicators for more robust trading strategies.

In conclusion, mastering the Morning Star Pattern can significantly improve your trading decisions and help you navigate market trends with confidence. If you’re eager to enhance your skills further, there’s no better place than Forex Bit. Join us today to learn Forex and take your trading to the next level!

As a Financial Blogger with 5 years of experience, I focus on delivering in-depth market insights, investment strategies, and personal finance advice. My content has helped a diverse audience navigate the complexities of financial planning and stay informed about the latest trends in the financial world.

Email: [email protected]