The ADX Indicator, short for Average Directional Index, is a powerful tool in technical analysis used to measure the strength and direction of market trends. It helps traders make informed decisions in both trending and range-bound markets.

The ADX Indicator is a versatile tool that not only identifies strong trends but also helps traders avoid false signals in volatile markets. Discover how this essential indicator can enhance your trading strategies by reading the full guide at Forex Bit!

What Is the ADX Indicator?

The ADX Indicator, developed by J. Welles Wilder, is a technical analysis tool used to quantify the strength of a trend, regardless of its direction. It is part of the Directional Movement System, which includes the Positive Directional Indicator (+DI) and Negative Directional Indicator (−DI). Together, these components help traders identify whether a market is trending and how strong the trend is.

How the ADX Indicator Works

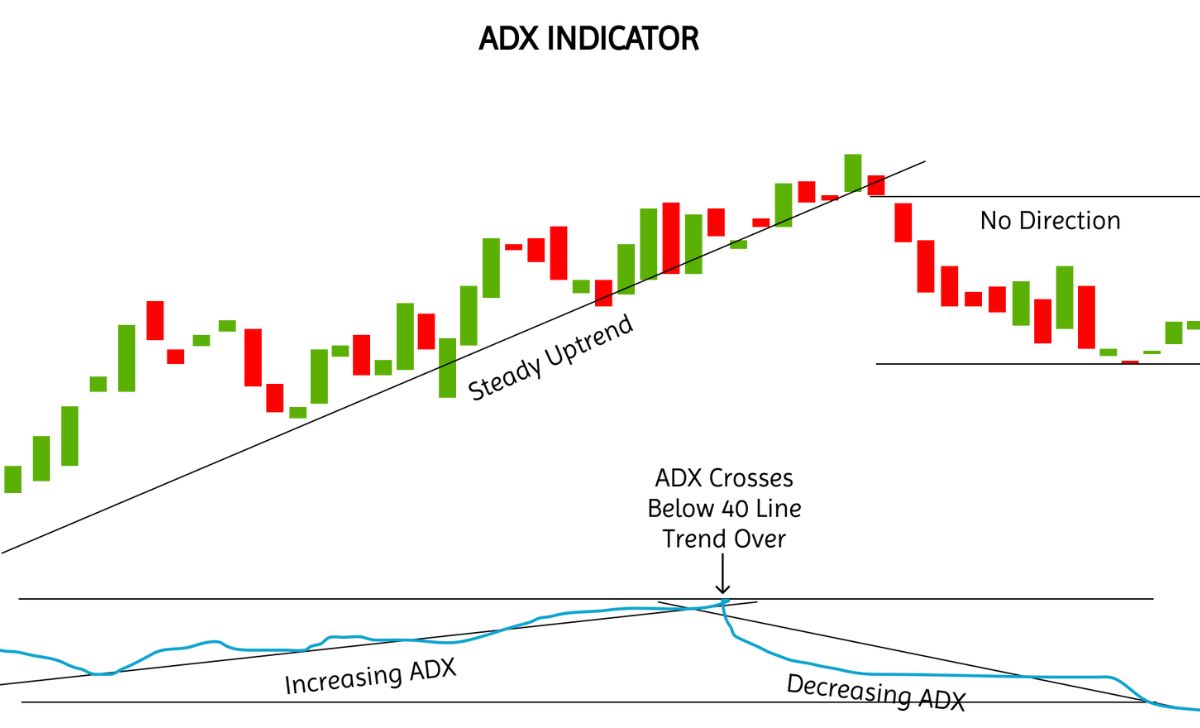

The ADX is plotted as a single line on a scale ranging from 0 to 100. Here’s how to interpret its readings:

- 0-25: Indicates a weak or non-existent trend. The market may be range-bound.

- 25-50: Suggests a moderate trend. Traders can begin exploring potential opportunities.

- 50-75: Signals a strong trend. This is where breakout strategies can thrive.

- 75-100: Indicates an extremely strong trend, often associated with high volatility.

The higher the ADX value, the stronger the trend—regardless of whether the trend is upward or downward.

Using the ADX Indicator in Forex Trading

The ADX Indicator in forex trading is particularly useful for identifying profitable trends and avoiding false breakouts. By pairing the ADX with the +DI and −DI lines, traders can:

- Spot Entry Points: When the +DI crosses above −DI, it may signal a potential buy opportunity. Conversely, a −DI crossing above +DI may indicate a sell opportunity.

- Confirm Trends: An ADX reading above 25 often confirms the presence of a sustainable trend, reducing the risk of entering during a false breakout.

- Exit Strategies: A declining ADX can signal a weakening trend, suggesting it might be time to exit a position.

Advantages of the ADX Indicator

- Versatility: The ADX can be applied to any market, including forex, stocks, and commodities.

- Objectivity: By quantifying trend strength, the ADX removes much of the subjectivity in technical analysis.

- Improved Risk Management: Knowing when a trend is strong or weak helps traders adjust their strategies accordingly.

Limitations of the ADX Indicator

While powerful, the ADX Indicator is not without its drawbacks:

- Lagging Nature: As a trend-following tool, the ADX may provide signals slightly after a trend begins.

- Complexity: Beginners may find it challenging to interpret the interaction between ADX, +DI, and −DI lines.

- Lack of Directional Clarity: The ADX measures trend strength but doesn’t indicate its direction. This requires complementary analysis with the +DI and −DI lines.

How to Use ADX In-Depth for Better Results

To maximize the potential of the ADX Indicator, consider these tips:

- Combine with Other Indicators: Pair the ADX with moving averages or oscillators to confirm trends and identify potential reversals.

- Set Alerts: Many trading platforms allow you to set alerts when the ADX crosses certain thresholds, helping you stay informed.

- Backtest Strategies: Always test your strategies using historical data to understand how the ADX performs under different market conditions.

Practical Example: ADX in Action

Imagine trading EUR/USD, and the ADX reading climbs above 30, indicating a strong trend. The +DI line crosses above the −DI line, confirming bullish momentum. You decide to enter a long position and set your stop-loss below the recent support level. As the trend continues, the ADX peaks at 50 before gradually declining, signaling it’s time to lock in profits and exit the trade.

Why You Should Use the ADX Indicator in Forex

For forex traders, the ADX Indicator is invaluable for identifying market trends, optimizing entry and exit points, and minimizing risks. By understanding the nuances of ADX readings and incorporating them into your strategy, you can gain a competitive edge in the fast-paced forex market.

In conclusion, the ADX indicator is a valuable tool for measuring market trends and their strength. Understanding how to use ADX can improve your trading decisions. To deepen your knowledge and learn Forex effectively, join Forex Bit today!

As a Financial Blogger with 5 years of experience, I focus on delivering in-depth market insights, investment strategies, and personal finance advice. My content has helped a diverse audience navigate the complexities of financial planning and stay informed about the latest trends in the financial world.

Email: [email protected]