The Engulfing Pattern Candle is a powerful technical analysis tool that signals potential market reversals. This pattern, formed by two candles, provides traders with valuable insights into price action, helping them make informed decisions in the market.

The Engulfing Pattern Candle is a key indicator used by traders to identify potential price reversals in the market. To fully understand how to use this powerful tool and improve your trading strategy, keep reading this article from Forex Bit.

What Is an Engulfing Pattern Candle?

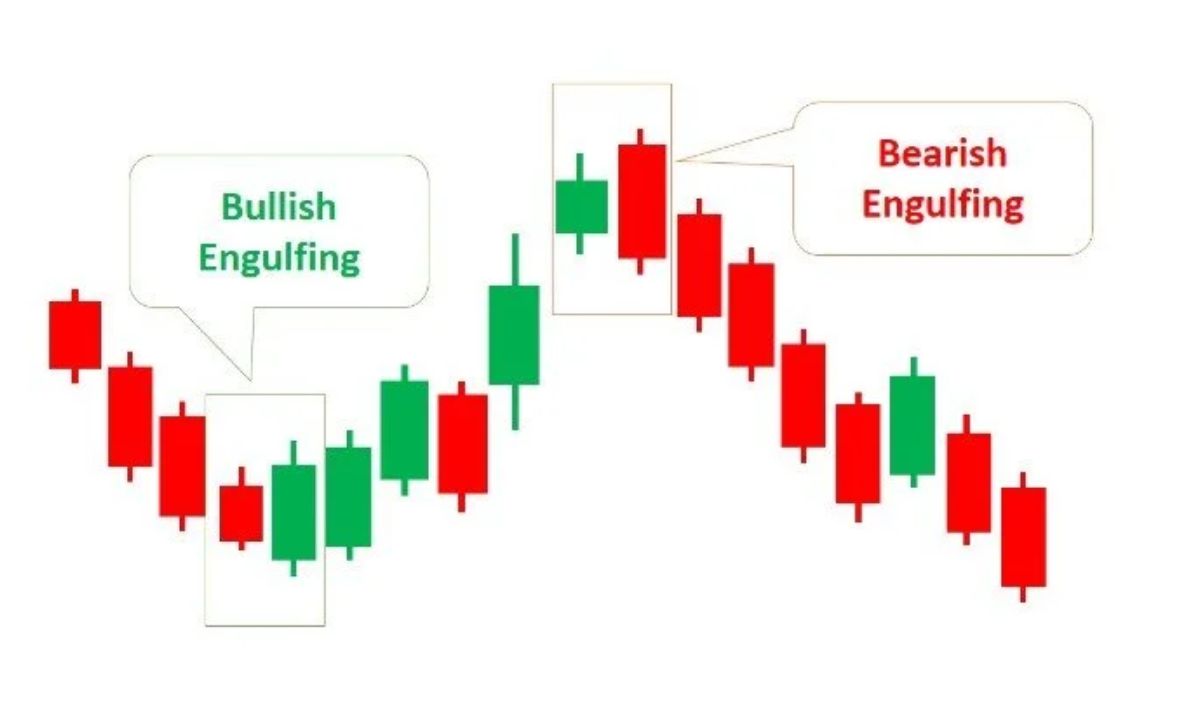

The engulfing pattern candle is a two-candle formation that signals a potential market reversal. It occurs when a smaller candle is followed by a larger candle that completely engulfs the body of the first candle. This pattern is commonly used in both bullish and bearish market scenarios.

- Bullish Engulfing Pattern Candle: This occurs at the end of a downtrend. A smaller bearish candle is followed by a larger bullish candle, suggesting that buyers are gaining control and a reversal to the upside may occur.

- Bearish Engulfing Candle: This appears at the end of an uptrend. A smaller bullish candle is followed by a larger bearish candle, indicating that sellers have taken over and a downward reversal might follow.

Key Characteristics of the Engulfing Pattern Candle

To accurately identify an engulfing pattern candle, look for these features:

- Two-Candle Formation: The first candle must be smaller and can be bullish or bearish, while the second candle must completely engulf the body of the first candle.

- Trend Context: It typically forms at the end of an existing trend, signaling a potential reversal.

- Engulfing Body: The body of the second candle must completely cover the body (not necessarily the wicks) of the first candle.

How to Spot a Bullish Engulfing Pattern Candle

A bullish engulfing pattern candle occurs after a downtrend and indicates that buyers are overpowering sellers. Here’s how to recognize it:

- The first candle is bearish (red or black) and small, showing continued selling pressure.

- The second candle is bullish (green or white) and significantly larger, completely engulfing the body of the first candle.

- It usually forms at a key support level, providing further confirmation of a potential reversal.

How to Spot a Bearish Engulfing Candle

A bearish engulfing candle is the opposite of its bullish counterpart and signals a potential downward reversal. Key identifying features include:

- The first candle is bullish and small, reflecting the continuation of the uptrend.

- The second candle is bearish and larger, engulfing the body of the first candle entirely.

- It often appears at resistance levels, strengthening the bearish signal.

Bearish Engulfing Candle Example

Imagine an asset in an uptrend, with prices forming higher highs and higher lows. On a particular day, a small green candle appears, followed by a larger red candle that engulfs the previous green candle. This is a classic example of a bearish engulfing candle and often marks the start of a downward trend.

How to Use the Engulfing Pattern Candle in Trading

Here are some practical steps to effectively use the engulfing pattern candle in your trading strategy:

- Identify the Trend: Ensure the pattern forms at the end of a clear trend (uptrend for bearish patterns, downtrend for bullish patterns).

- Confirm with Volume: High trading volume during the second candle strengthens the reliability of the signal.

- Combine with Other Indicators: Use additional tools like RSI, MACD, or support and resistance levels to confirm the signal.

- Set Entry and Exit Points: Enter the trade after the pattern completes and consider placing stop-loss orders beyond the high or low of the engulfing candle for protection.

- Practice on Demo Accounts: For beginners, practicing on a demo account helps you understand the pattern’s behavior without risking real money.

Benefits of Using the Engulfing Pattern Candle

The engulfing pattern candle offers several advantages:

- Easy to Identify: The pattern is straightforward to spot on candlestick charts, even for beginners.

- Reliable Reversal Signal: It provides a clear indication of a potential market reversal.

- Versatile Application: Works across various financial instruments, including Forex, stocks, and commodities.

Limitations of the Engulfing Pattern Candle

Despite its usefulness, the engulfing pattern candle has some limitations:

- False Signals: It can produce false signals in choppy or sideways markets.

- Requires Confirmation: Additional indicators or analysis are often needed to confirm the pattern’s validity.

- Not a Standalone Tool: It should be used as part of a broader trading strategy rather than in isolation.

Tips for Beginners

- Study Historical Charts: Analyze historical data to see how the engulfing pattern candle behaves under different market conditions.

- Start Small: Begin with small trades to manage risk while learning.

- Stay Updated: Follow market news and trends to understand the context behind price movements.

In conclusion, mastering the Engulfing Pattern Candle can significantly enhance your trading decisions and help you navigate market trends more effectively. To deepen your knowledge and skills in trading, we encourage you to learn Forex at Forex Bit. Join us today and start your journey toward becoming a successful trader!

As a Financial Blogger with 5 years of experience, I focus on delivering in-depth market insights, investment strategies, and personal finance advice. My content has helped a diverse audience navigate the complexities of financial planning and stay informed about the latest trends in the financial world.

Email: [email protected]