A reversal candlestick pattern is a chart formation that signals a potential trend reversal in the market. It helps traders identify shifts from bullish to bearish trends or vice versa, enabling better trading decisions.

Reversal candlestick patterns are essential tools in trading, providing clear signals of potential market trend reversals. Discover how to use them effectively today at Forex Bit!

What is a Reversal Candlestick Pattern?

A reversal candlestick pattern is a chart pattern that signals the potential end of an ongoing trend and the start of a new one in the opposite direction. These patterns appear at key points in the market and are formed by one or more candlesticks.

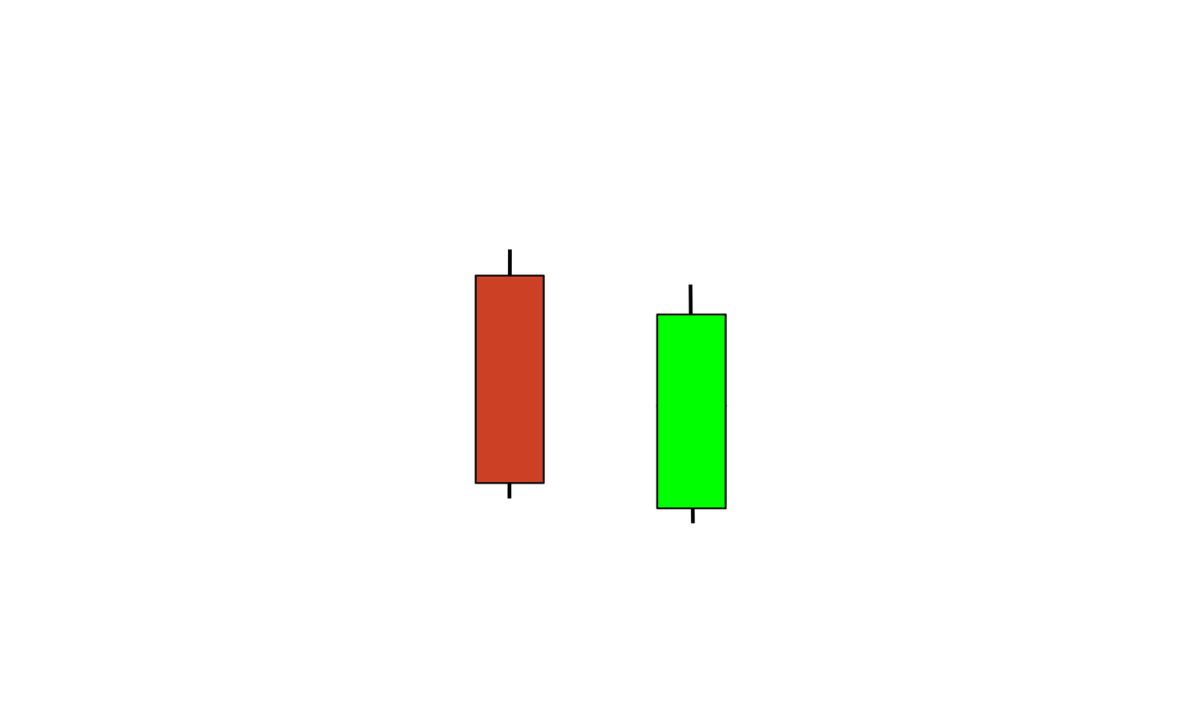

Reversal candlestick patterns are categorized into two main types:

- Bullish Reversal Candlestick Pattern: Indicates a possible shift from a downtrend to an uptrend.

- Bearish Reversal Candlestick Pattern: Suggests a transition from an uptrend to a downtrend.

Understanding these patterns can help traders identify high-probability trade setups and time their entries and exits more effectively.

Types of Reversal Candlestick Patterns

There are various types of reversal candlestick patterns, each signaling a potential shift in market trends.

Bullish Reversal Candlestick Pattern

A bullish reversal candlestick pattern often forms at the end of a downtrend, signaling that buyers are gaining momentum and pushing the price higher. Key examples include:

- Hammer: Characterized by a small body and a long lower wick, the hammer shows strong rejection of lower prices and the possibility of an upward reversal.

- Morning Star: A three-candlestick pattern where a small-bodied candle (often a Doji) follows a large bearish candle, followed by a large bullish candle, signaling a shift in market sentiment.

- Bullish Engulfing: This pattern occurs when a bullish candle completely engulfs the previous bearish candle, indicating a strong buying force.

Bearish Reversal Candlestick Pattern

A bearish reversal candlestick pattern appears at the peak of an uptrend, signaling that sellers are taking control of the market. Some popular bearish patterns include:

- Shooting Star: A small body with a long upper wick, this pattern shows that buyers tried to push the price higher but faced strong resistance.

- Evening Star: The bearish counterpart to the Morning Star, this three-candlestick pattern signals the shift from bullish to bearish dominance.

- Bearish Engulfing: When a bearish candle engulfs the previous bullish candle, it signals that selling pressure is overpowering buying pressure.

Strong Reversal Candlestick Pattern

Some patterns are particularly powerful and reliable for predicting trend changes:

- Doji: This pattern represents indecision in the market. When it forms after a strong trend, it often signals a reversal.

- Piercing Line: A bullish pattern where the bullish candle closes above the midpoint of the previous bearish candle.

- Dark Cloud Cover: A bearish pattern where the bearish candle closes below the midpoint of the previous bullish candle, signaling a downward reversal.

How to Trade Using Reversal Candlestick Patterns

Reversal candlestick patterns are effective tools, but their reliability improves when combined with additional analysis. Here are some tips for trading with these patterns:

Confirm with Volume

High trading volume accompanying a reversal pattern strengthens its validity. A significant increase in volume often confirms a genuine trend change.

Use Technical Indicators

Combine candlestick patterns with indicators like Relative Strength Index (RSI), Moving Averages, or Bollinger Bands for added confirmation. For example, an overbought RSI combined with a bearish reversal candlestick pattern strengthens the sell signal.

Set Clear Entry and Exit Points

Once a reversal pattern forms, use the high and low of the pattern as potential entry and stop-loss points.

Analyze Multiple Timeframes

Check patterns across different timeframes to ensure consistency. A strong reversal pattern on a higher timeframe holds more weight than one on a lower timeframe.

Limitations of Reversal Candlestick Patterns

While reversal candlestick patterns are reliable, they are not infallible. Here are some limitations to consider:

- False Signals: Patterns may produce false signals in volatile or low-volume markets.

- Context-Dependent: Reversal patterns are most effective when identified at strong support or resistance levels.

- Requires Confirmation: Never rely solely on a reversal candlestick pattern; always seek confirmation through other tools and strategies.

Why Use Reversal Candlestick Patterns in Trading?

Reversal candlestick patterns provide traders with early warnings of potential trend changes, allowing them to adjust their positions accordingly. Whether spotting a bullish reversal candlestick pattern to enter a new uptrend or a bearish reversal candlestick pattern to exit before a downtrend, these patterns can save traders from significant losses and help capitalize on market opportunities.

In conclusion, mastering reversal candlestick patterns can significantly enhance your trading strategy by helping you identify potential trend changes. By understanding these patterns, you can make more informed and timely decisions in the market. To deepen your knowledge and learn Forex, join Forex Bit today!

As a Financial Blogger with 5 years of experience, I focus on delivering in-depth market insights, investment strategies, and personal finance advice. My content has helped a diverse audience navigate the complexities of financial planning and stay informed about the latest trends in the financial world.

Email: [email protected]